Nutraceutical excipients are inactive ingredients used in the formulation of dietary supplements and functional foods. While they do not offer direct nutritional value, their role is vital in enhancing bioavailability, taste, stability, shelf life, and absorption of active ingredients. In Europe, the nutraceutical excipients market has gained substantial traction as health-conscious consumers demand high-quality, convenient, and effective supplements. As more individuals shift toward preventative health and natural wellness solutions, the use of advanced excipients in nutraceutical products continues to grow rapidly across the region.

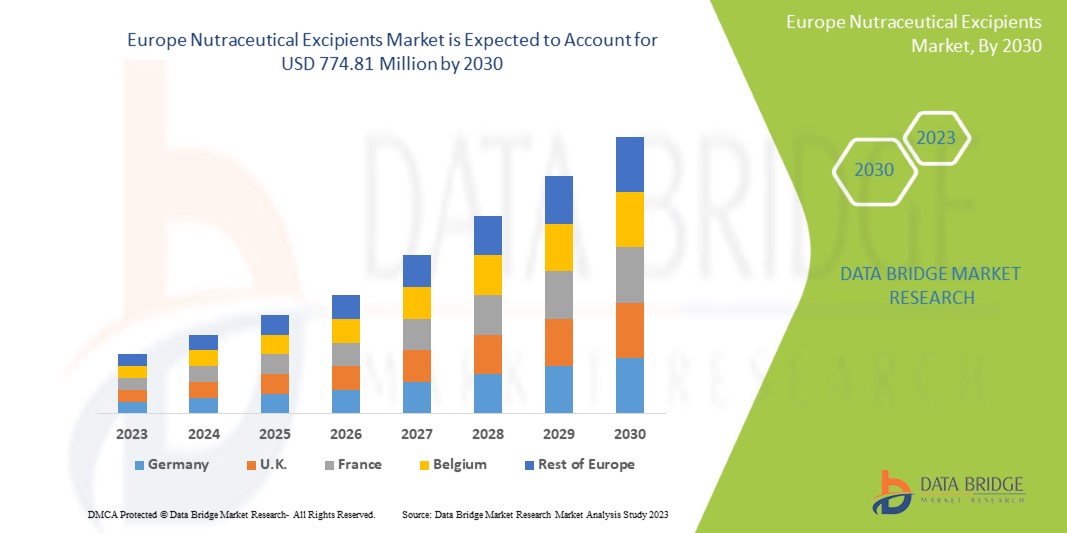

Data Bridge Market Research analyzes that the Europe nutraceutical excipients market is expected to reach the value of USD 774.81 million by 2030, at a CAGR of 7.3% during the forecast period. Binders account for the largest segment in the market due to the rapid demand globally. This market report also covers pricing analysis, patent analysis, and technological advancements in depth.

Get the PDF Sample Copy (Including FULL TOC, Graphs and Tables) of this report @

Market Size

The Europe nutraceutical excipients market was valued at approximately USD 1.2 billion in 2022. Forecasts indicate strong growth, with the market projected to reach over USD 1.9 billion by 2029. This represents a compound annual growth rate (CAGR) of around 6.5%. This growth is driven by increasing demand for dietary supplements, vitamins, minerals, and functional foods. The aging population, rising healthcare awareness, and preference for self-care among European consumers contribute to the expansion of this market. Pharmaceutical-grade excipients are in demand for their ability to improve product performance, ensure dosage uniformity, and enable diverse formats such as tablets, powders, and soft gels.

Market Share

Western Europe dominates the regional market with the largest share. Countries like Germany, France, the United Kingdom, and Italy lead in terms of both consumption and production of nutraceutical products. Germany stands out as a major hub, with strong R&D capabilities and a thriving health supplement industry. The United Kingdom follows closely, driven by robust e-commerce growth and consumer emphasis on immunity and general well-being. Southern European nations such as Spain and Italy are witnessing increasing demand for natural and plant-based supplements, further propelling excipient use. Eastern Europe, while currently holding a smaller market share, is showing accelerated growth due to rising urbanization and an expanding middle-class population.

Market Opportunities and Challenges

Europe offers numerous opportunities for excipient manufacturers and nutraceutical brands. The rising trend toward personalized nutrition is creating demand for customized formulations, pushing the development of innovative excipients that enhance functionality. The demand for clean-label supplements is another major opportunity. Consumers now prefer excipients that are natural, allergen-free, gluten-free, and vegan. This trend is opening the door for excipients derived from natural sources such as cellulose, starch, and gums.

The regulatory environment in Europe supports high-quality standards. Although stringent, the European Food Safety Authority (EFSA) guidelines ensure product credibility, encouraging consumer trust and long-term market growth. This creates opportunities for companies willing to invest in compliance and premium formulations. The increasing popularity of alternative delivery formats such as gummies, orodispersible tablets, and liquid sachets is also boosting demand for excipients that can support varied product types.

Despite these opportunities, the market faces challenges. Regulatory hurdles and approval processes are complex and time-consuming. Manufacturers must invest in documentation, testing, and compliance to meet the requirements of multiple national authorities within the EU. The cost of producing high-quality excipients is relatively high, which can restrict small-scale players and raise end-product prices. Another challenge lies in the fragmented consumer base, with varying preferences, health concerns, and supplement habits across different countries. This diversity requires region-specific strategies and formulations, increasing complexity for manufacturers.

Market Demand

The demand for nutraceutical excipients in Europe is being driven by increased consumption of dietary supplements aimed at immunity, joint health, cardiovascular wellness, and cognitive function. Older adults are a significant consumer base, driving demand for easy-to-swallow tablets, capsules, and powder mixes. Products catering to active lifestyles, sports nutrition, and digestive health are also on the rise, further increasing the use of excipients like binders, disintegrants, and stabilizers.

The COVID-19 pandemic played a major role in boosting demand for immune-supporting supplements, a trend that continues today. With consumers now more proactive about their health, the use of scientifically formulated nutraceuticals has surged. Excipients that improve ingredient absorption, enhance solubility, and ensure accurate dosage delivery are essential in these products.

Flavor masking, improved texture, and color stability are in high demand, particularly in chewables and gummies. Excipients that ensure taste uniformity and prevent degradation of active ingredients are essential in these popular delivery formats. The children’s and women's health supplement categories are expanding, increasing demand for excipients compatible with sensitive or complex formulations.

Market Trends

Several key trends are defining the nutraceutical excipients market in Europe. Clean-label excipients are among the most important. Consumers are closely examining product labels, demanding transparency and simplicity. This has led to the adoption of plant-based and naturally sourced excipients that align with organic, vegan, and non-GMO claims. Natural gums, prebiotic fibers, and starch derivatives are becoming preferred choices.

Sustainability is another strong trend. Manufacturers are moving toward eco-friendly sourcing, biodegradable materials, and green manufacturing practices. Recyclable packaging, carbon footprint reduction, and ethical sourcing of raw materials are becoming standard expectations in the European market.

Personalized nutrition is reshaping product development. With the rise of digital health tools and DNA-based diet insights, consumers want supplements tailored to their needs. This requires flexible and multi-functional excipients that can support small-batch production and diversified formulation demands.

Technological innovation in excipient development is also on the rise. Co-processed excipients, which combine two or more excipients into a single particle system, are gaining traction for improving compressibility, stability, and solubility. Encapsulation technologies are becoming popular to protect sensitive ingredients and improve targeted delivery.

The popularity of plant-based and vegan lifestyles is prompting a shift toward animal-free excipients. Gelatin-free capsules, cellulose-based binders, and natural colorants are being widely adopted. The functional food and beverage segment is also growing, driving demand for excipients that offer moisture control, taste enhancement, and emulsion stability.

Digital sales channels are shaping market access. E-commerce and direct-to-consumer models are expanding the reach of nutraceutical products across Europe. Online platforms are fueling rapid product innovation, supported by quick customer feedback and market analytics.

Conclusion

The Europe nutraceutical excipients market is poised for steady growth driven by evolving consumer preferences, rising health awareness, and continuous product innovation. While regulatory complexities and price sensitivity pose challenges, the opportunities outweigh the risks. Clean-label excipients, sustainable practices, personalized nutrition, and advanced delivery formats are steering the market into a new era. As more companies invest in research, formulation, and quality compliance, Europe will continue to be a hub for cutting-edge nutraceutical development supported by high-performance excipients.

Write a comment ...